Running a small business is like navigating a winding river. One moment, the waters are smooth — customers are happy, sales are rolling in, and you’re thinking about your next move. The next, a late payment, an unexpected bill, or a seasonal slump hits your cash reserves. Even with a great product and loyal clients, your business can quickly veer off course if the money doesn’t flow when it’s needed.

You’re not alone. A QuickBooks survey found that 2 out of 5 small business owners (42%) experienced cash flow problems in the past year, and 61% say they’ve faced cash flow challenges at some point while running their business. Even more striking, nearly one-third (32%) have been unable to pay vendors, repay loans, or even cover payroll — including their own pay — due to cash flow issues.

A simple, realistic cash flow forecast helps you take back control. It shows what’s coming in, what’s going out, and when — so you can plan ahead with clarity instead of reacting in crisis mode.

This step-by-step guide will walk you through how to build a reliable forecast, avoid common mistakes, and use your numbers to make better business decisions. We’ll even include templates to help you get started today.

Table of Contents

- Understanding Cash Flow Forecasting

- Step-by-Step Guide to Creating a Cash Flow Forecast

- Templates

- What’s Next?

Understanding Cash Flow Forecasting

A cash flow forecast predicts how much cash will flow into and out of your business over a period, such as a month or year. It shows the real money coming in and going out of your business — for example, when a customer actually pays a $1,000 invoice or when you pay your rent — not just projected sales or income like a profit and loss statement does. Small businesses often use the direct method, listing actual payments for short-term plans. It’s like checking your bank balance for accuracy. The indirect method estimates cash using overall financial reports, better for long-term goals but less precise. Used consistently, it helps you stay prepared, stable, and ready to grow.

Why does this matter? A cash flow forecast helps you avoid cash shortages, letting you pay suppliers and staff with confidence. It reveals when you can invest in growth, like new equipment. It also strengthens loan applications by showing smart money management. Without a forecast, you risk missing bills or stalling growth.

Now that you know why it matters, let’s walk through how to build a cash flow forecast step by step.

Step-by-Step Guide to Creating a Cash Flow Forecast

These eight steps will help you build a cash flow forecast that’s accurate and practical. Each step is straightforward, ideal for small business financial planning.

Step 1: Set Your Goal and Time Frame

Decide why you’re forecasting—covering monthly bills, planning a purchase, or preparing for a loan. Choose a time frame:

- Short-term (1–3 months): Tracks daily needs, like payroll. Use the direct method.

- Medium-term (3–6 months): Plans for investments or seasonal dips.

- Long-term (6–12 months): Supports growth or loan applications.

Most small businesses, especially retailers managing rent and inventory, start with a monthly, three-month forecast for simplicity and accuracy.

Step 2: Collect Historical Data

Your cash flow forecast needs a strong foundation. Gather past financials to identify patterns, like seasonal sales or recurring costs:

- Bank statements: Show cash inflows (e.g., sales) and outflows (e.g., rent).

- Sales records: Highlight trends, like holiday spikes.

- Expense logs: List fixed costs (e.g., salaries) and variable costs (e.g., utilities).

New businesses can estimate based on industry norms as a practical starting point, but your business has unique patterns. Reviewing at least six months of historical data will give you a clearer, more reliable picture.

Step 3: List Cash Inflows

Identify all cash entering your business during the forecast period. Focus on actual payments, not potential sales. Key inflows include:

- Sales receipts: Base on past sales (e.g., last year’s January for this January), adjusting for growth (e.g., 5% increase) or slowdowns.

- Other cash: Loans, grants, or refunds.

Check accounts receivable to see when clients pay (e.g., 30 days after invoicing). Use historical sales patterns, like December retail spikes, for accurate cash flow forecasting. Be cautious—expect some late payments.

Step 4: List Cash Outflows

List all cash leaving your business, dividing into:

- Fixed costs: Rent, salaries, loan payments—consistent each month.

- Variable costs: Inventory, marketing—vary with sales.

- One-off costs: Equipment, annual taxes.

Review accounts payable to know when bills are due. Experts suggest checking sales records to estimate variable costs and noting irregular expenses, like annual subscriptions, to avoid surprises. For example, include $1,000 marketing costs only for peak-season months.

Step 5: Calculate Net Cash Flow

Subtract outflows from inflows for each period (e.g., month) to find net cash flow:

- Positive: More cash in than out—ideal for saving or investing.

- Negative: More cash out than in—reduce costs or increase sales.

Use: Net Cash Flow = Inflows – Outflows. Experts note a 5% variance between projections and actuals is acceptable, but larger gaps require revising assumptions. For example, if inflows are $10,000 and outflows $9,000, your net cash flow is $1,000.

Step 6: Determine Opening and Closing Balances

Start with your opening cash balance—the cash in your bank account at the period’s start, found on your bank statement. Then:

- Add net cash flow to get the closing balance.

- Use the closing balance as the next period’s opening balance.

For example, an opening balance of $8,000 plus $1,000 net cash flow gives a $9,000 closing balance, which starts the next month. Templates simplify this with spreadsheet formulas.

Step 7: Build Your Forecast

Combine your data into a cash flow forecast. Use a spreadsheet or template to organize:

- Columns for each period (e.g., January, February).

- Rows for inflows, outflows, net cash flow, and balances.

Input estimates from Steps 3–6. Verify fixed costs (e.g., $2,000 rent) and adjust variable costs based on sales trends. Organized forecasts help retailers avoid inventory shortages. Test your forecast by comparing one month’s predictions to actuals.

Step 8: Review and Update Monthly

Compare your cash flow forecast to actual cash flows monthly. If you predicted $6,000 in sales but got $5,000, adjust future estimates. Update for:

- New sales (e.g., a big client).

- Unexpected costs (e.g., repairs).

- Market shifts (e.g., rising costs).

Experts emphasize that regular checks against actuals catch errors and improve accuracy. Weekly reviews keep your cash flow management sharp.

Templates

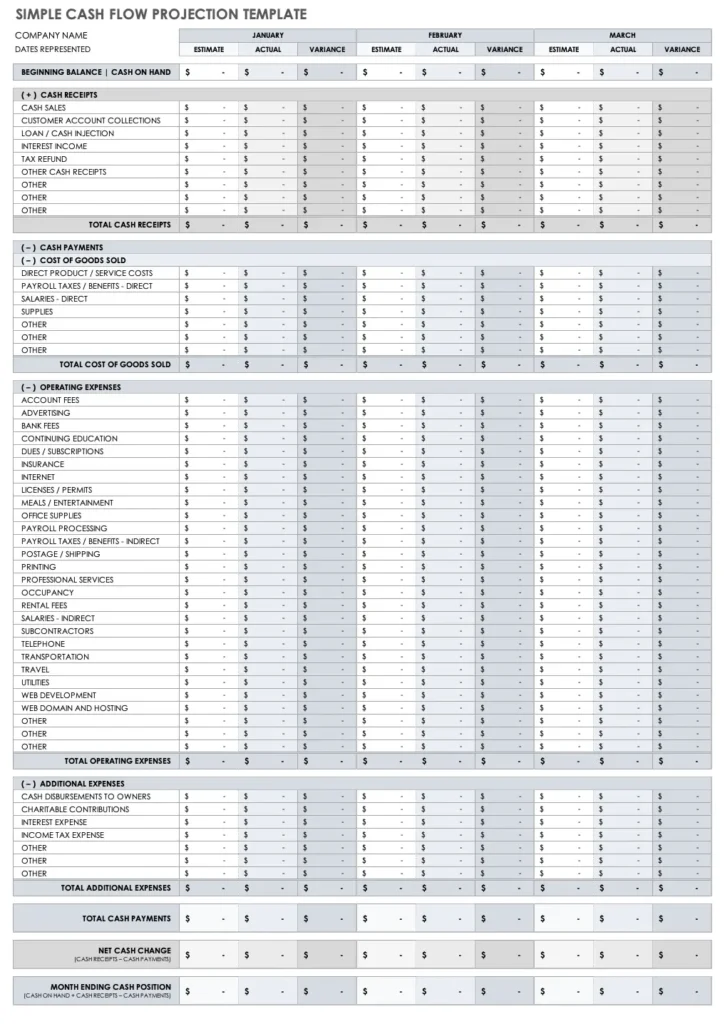

A cash flow forecast template saves time and reduces errors. Explore these options:

- Smartsheet: Offers templates for daily, quarterly, 12-month, or 3-year forecasts, tailored for small businesses to ensure adequate cash for obligations.

See the template: Smartsheet Cash Flow Forecast Template

- Microsoft: Provides an Excel template for small businesses, covering a full fiscal year. It automatically sums values, totals periods, and carries balances month to month.

See the template: Microsoft Small Business Cash Flow Forecast

- NetSuite: Features a four-week forecast template for ongoing updates, with an “Actual” row to compare real results to projections.

See the template: NetSuite Cash Flow Forecasting

- Legal Aid Agency: This UK-based template from the Ministry of Justice offers detailed guidance that can inspire U.S. businesses, with adjustments for local regulations.

See the template: Legal Aid Agency Cash Flow Forecast Template

What’s Next

A cash flow forecast is your key to financial control, helping you avoid cash shortages and plan growth. By following these eight steps—setting goals, collecting data, estimating inflows and outflows, calculating cash flow, setting balances, building, and reviewing your forecast—you’ll stay ahead of pitfalls. Using accounting templates and avoiding mistakes like overly optimistic estimates ensures your forecast works.

Ready to master cash flow management? Our small business financial planning solutions offer automated forecasting, real-time insights, and expert support to keep your cash flowing. Schedule a call with our team to learn more.

For more financial tips, check out our blogs: