We put in the work, we deliver the results — getting paid should be the easy (and rewarding) part, right?

But for many freelancers and small business owners, it’s not always smooth sailing. Missed due dates, unclear invoices, and delayed payments can cause major cash flow problems. According to a survey by Melio and YouGov, the majority of U.S. small business owners say they’ve experienced late payments — especially from larger clients. Alarmingly, 30% say those delays impact their ability to stay in business.

If you want your business to run smoothly and get paid on time, mastering invoicing is essential. It’s more than just paperwork — it’s the backbone of your cash flow. In this guide, we’ll cover five critical aspects of invoicing that help ensure you get paid, plus provide tips, examples, and a template to make your process easier.

Table of Contents

- Why Invoicing Matters for Your Business

- 5 Critical Aspects of Invoicing to Get Paid

- Practical Tips to Avoid Late Payments

- Invoice Template Essentials

- Next Steps

Why Invoicing Matters for Your Business

Effective invoicing is key to your business’s financial health. It ensures you have the cash to pay bills, reinvest, and stay afloat during slow periods. Poor invoicing — like sending them late, leaving out key info, or using unclear terms — often leads to late payments and miscommunication.

In fact, 60% of small businesses cite cash flow problems caused by delayed payments. But it’s not just about money: professional invoices build trust and help maintain strong client relationships. They set expectations, minimize disputes, and ensure you spend less time chasing payments — and more time growing your business.

5 Critical Aspects of Invoicing to Get Paid

To make sure you get paid on time, your invoices need to be clear, complete, and easy to act on. Here are five essentials to include:

1. Include Clear and Complete Details

Make sure your invoice includes all the necessary details. That includes your business name, the client’s name, an invoice number, the date, a breakdown of services or products provided, and the total amount owed. Don’t forget to include your contact information in case the client has questions. Using a consistent template helps keep everything organized and easy to understand.

2. Set Clear Payment Terms from Day One

Always set clear payment terms upfront. This tells your client when and how to pay. For example, “Net 30” means the payment is due within 30 days. Make these terms easy to spot on the invoice. Also, list which payment methods you accept: whether it’s credit card, bank transfer, PayPal, or another option. The easier you make it to pay, the faster you’ll get your money.

3. Send Invoices Promptly

Don’t wait to send your invoices. The sooner you send them, the sooner you can expect to be paid. A good rule of thumb is to invoice within 24 to 48 hours after completing the work. Using email or invoicing software can help speed up the process and track what’s been sent.

4. Make Invoices Professional and Branded

Keep your invoices looking clean and professional. A well-designed invoice shows that you take your business seriously. It helps build trust with clients and avoids confusion. You can use tools like Canva, FreshBooks, or Fynlo to create professional invoices with your logo and brand colors.

5. Follow Up (Without Feeling Pushy)

Have a follow-up plan in case a client misses the due date. A simple check-in a few days before the due date, another one on the due date, and a final one if the invoice becomes overdue can make a big difference. If the payment still doesn’t come through, consider pausing any future work until it’s resolved.

Practical Tips to Avoid Late Payments

Beyond crafting clear and professional invoices, implementing strategic practices can significantly reduce payment delays:

1. Automate Payment Reminders: Utilize invoicing software to send automatic reminders a few days before the due date. This proactive approach keeps your invoice top-of-mind for clients and encourages timely payments.

2. Offer Multiple Payment Options: Providing various payment methods—such as credit cards, bank transfers, PayPal, or Stripe—makes it convenient for clients to pay promptly. The easier the process, the faster you get paid.

3. Implement a Clear Late Fee Policy: Clearly state your late payment terms on the invoice. For example: “A late fee of 2% will be applied to invoices unpaid after 7 days past the due date.” This transparency sets expectations and incentivizes on-time payments.

4. Establish a Dedicated Client Contact: Identify and communicate with the specific person responsible for payments within your client’s organization. Direct communication can expedite the payment process and resolve issues swiftly.

5. Utilize Early Payment Incentives: Consider offering small discounts for early payments. For instance, a 2% discount for payments made within 10 days can motivate clients to prioritize your invoice.

6. Regularly Review Outstanding Invoices: Set a routine to monitor unpaid invoices. Regular reviews help you stay on top of your accounts receivable and address any issues before they escalate.

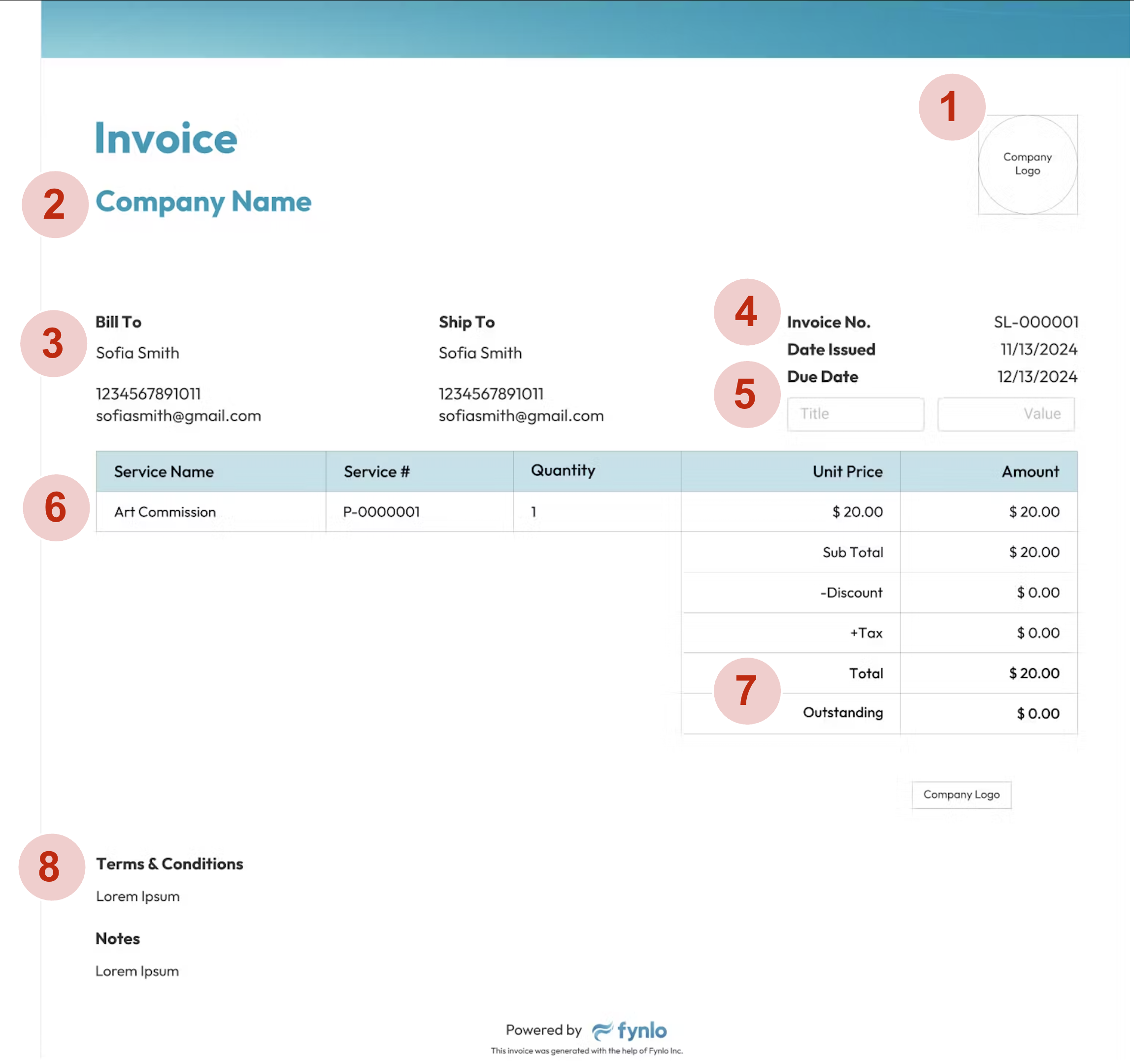

Invoice Template Essentials

| Section | What to Include |

| 1. Company Logo | Your company logo. |

| 2. Header | Your business name, address, email, and phone number. |

| 3. Bill To | Client’s name or business, their address, and contact info. |

| 4. Invoice Number, Invoice Date | Invoice Number: Unique ID like INV-105; it helps with tracking and follow-up. Invoice Date: The date the invoice is issued. |

| 5. Due Date | The clear deadline for payment (e.g., “Due: June 15, 2025”). |

| 6. Itemized List | A breakdown of each product/service, quantity, rate, and total. Include dates for service delivery. |

| 7. Total Amount Due | Final amount owed. Highlight this clearly. |

| 8. Payment Instructions, Terms & Conditions | Payment Instructions: Bank transfer info, PayPal/Stripe link, etc. Payment Terms: Payment terms, late fee policies, refund clauses, etc. |

Next Steps

Effective invoicing is more than just sending a bill—it’s about establishing clear communication, setting expectations, and fostering trust with your clients. By implementing the strategies outlined above, you can enhance your cash flow and reduce the stress associated with late payments.

Ready to streamline your invoicing process? Tools like Fynlo can help you create branded invoices, automate reminders, and track payments efficiently.