As a small business owner or freelancer, your time is your most valuable asset. Between managing clients, delivering services, and growing your business, bookkeeping can feel like a relentless time sink. Manual tasks like invoicing, expense tracking, and payroll eat up hours that could be spent on high-value work. Fortunately, accounting automation is transforming how small businesses manage finances, offering time-saving accounting tools that streamline processes and boost efficiency.

According to the 2024 Intuit QuickBooks Accountant Technology Survey, nearly all (98%) respondents say they’ve used AI to help clients over the last 12 months, with top applications including data entry and processing (69%), fraud detection and prevention (51%), and real-time financial insights (47%) For small business owners, adopting the best accounting automation for small business can save hours each week, reduce errors, and free you to focus on growth.

This guide explores 10 time-saving accounting automations every small business owner should implement. From automating bookkeeping to streamlining tax prep, these tools will help you automate small business finances with ease. Whether you’re a solo freelancer or running a small team, these solutions will keep your finances on track.

Table of Contents

- Why Accounting Automation Matters for Small Businesses

- 10 Time-Saving Accounting Automations to Implement

- What’s Next?

Why Accounting Automation Matters for Small Businesses

Small businesses face unique financial challenges: limited budgets, complex tax rules, and the need to stay competitive. Manual accounting tasks not only drain time but also increase the risk of errors that can lead to costly penalties. A Tech.co survey found that 75% of accountants reported a positive impact from automation, citing time savings, improved productivity, cloud access, enhanced data accuracy, and faster data retrieval as key benefits.

Accounting automation uses software and AI to handle repetitive tasks like data entry, invoicing, and reporting, freeing you to focus on strategic priorities. The Rightworks Accounting Firm Technology Survey 2024 revealed that early adopters of automation earn 39% more revenue per employee, proving its impact on profitability. By adopting small business accounting software with automation features, you can:

- Save Time: Automate bookkeeping tasks to reclaim hours each week.

- Reduce Errors: Eliminate manual data entry mistakes that lead to compliance issues.

- Improve Cash Flow: Speed up invoicing and payments with automated workflows.

- Stay Compliant: Ensure accurate tax filings and financial reports.

- Scale Efficiently: Handle growing transaction volumes without extra staff.

With the right time-saving accounting tools, you can automate small business finances and focus on what matters most—growing your business. ear and leveraging data, you can take your nonprofit to new heights.

10 Time-Saving Accounting Automations to Implement

Here are 10 easy bookkeeping automation solutions to streamline your small business finances:

1. Automated Invoicing

Manual invoicing demands significant effort and often leads to payment delays due to errors. Automated invoicing tools streamline the process by creating, sending, and tracking invoices instantly, ensuring timely payments. A PayStream Advisors study found that companies using automated invoice processing increased productivity by 33% and reduced processing costs by 42%.

- How It Works: Tools like QuickBooks or Xero generate invoices based on client data, send them via email, and monitor payment status in real time.

- Tools: QuickBooks, Xero, FreshBooks, Fynlo.

2. Expense Tracking Automation

Manually logging receipts requires considerable time and increases the risk of oversight. Small business expense tracking automation syncs bank transactions and categorizes expenses in real time, eliminating manual entry and ensuring accurate, up-to-date records.

- How It Works: Apps like Expensify, Zoho Expense, Receipt Bank, or Fynlo connect to your bank account, categorize transactions automatically, and store digital receipts for seamless access.

- Tools: Expensify, Zoho Expense, Receipt Bank.

3. Payroll Automation

Manually processing payroll—calculating wages, taxes, and deductions—is time-intensive and error-prone. Payroll automation ensures accurate, timely payments while maintaining compliance. According to the American Payroll Association, automation can reduce payroll processing costs by up to 80%.

- How It Works: Software like Gusto, ADP, or Paychex calculates wages, withholds taxes, deposits funds directly to employees’ accounts, and generates compliance reports.

- Tools: Gusto, ADP, Paychex.

4. Bank Reconciliation

Reconciling bank accounts manually is a tedious process that often results in errors. Automated reconciliation matches transactions between your books and bank statements, ensuring precision. According to HighRadius, 95% of reconciliation errors stem from manual mistakes.

- How It Works: Tools like QuickBooks, Wave, or Xero import bank feeds, align transactions automatically, and flag discrepancies for efficient review.

- Tools: QuickBooks, Wave, Xero.

5. Tax Preparation Automation

Tax season can overwhelm small business owners with complex deductions and filing requirements. Automating bookkeeping for taxes simplifies the process by organizing deductions and generating accurate reports for seamless compliance.

- How It Works: Software like TurboTax, TaxAct, or H&R Block automatically categorizes expenses, estimates quarterly taxes, and exports data for efficient, error-free filings.

- Tools: TurboTax, TaxAct, H&R Block.

6. Accounts Payable Automation

Manually processing vendor bills is inefficient and prone to delays. Accounts payable (AP) automation streamlines bill payments and approvals, enhancing operational efficiency. A Payouts.com report found that automated AP solutions can cut invoice processing times by up to 80%.

- How It Works: Tools like Bill.com, Tipalti, or Melio automate bill capture, approval workflows, and payments, integrating seamlessly with accounting software.

- Tools: Bill.com, Tipalti, Melio.

7. Accounts Receivable Automation

Chasing late payments consumes valuable time and disrupts cash flow. Accounts receivable (AR) automation sends reminders and tracks overdue invoices, improving collections. According to NetSuite, 85% of CFOs at companies with over 50% automated AR processes saw a decrease in days sales outstanding (DSO).

- How It Works: Software like FreshBooks, Zoho Invoice, or Invoice Ninja sends automated payment reminders and updates AR reports in real time.

- Tools: FreshBooks, Zoho Invoice, Invoice Ninja.

8. Financial Reporting Automation

Manual financial reporting is labor-intensive and susceptible to errors. Automated reporting generates real-time insights, such as profit and loss statements, with minimal effort. PWC states that automation can reduce financial reporting time by 30–40%.

- How It Works: Tools like QuickBooks, Sage Intacct, NetSuite, or Fynlo create customizable reports by pulling data directly from your financial records.

- Tools: QuickBooks, Sage Intacct, NetSuite, Fynlo.

9. Time Tracking Integration

Manually tracking billable hours is a challenge for service-based businesses, often leading to inaccurate billing. Automated time tracking streamlines invoicing and payroll processes by seamlessly integrating with accounting systems.

- How It Works: Apps like Toggl, Harvest, or Clockify automatically track hours and sync data to accounting software, ensuring accurate billing and payroll calculations.

- Tools: Toggl, Harvest, Clockify.

10. Budgeting and Forecasting Automation

Manual budgeting is complex and quickly outdated, hindering effective financial planning. Automated budgeting tools simplify cash flow projections and performance tracking for agile decision-making.

- How It Works: Software like Float, PlanGuru, or QuickBooks leverages historical data to generate real-time forecasts for revenue and expenses, keeping financial plans current.

- Tools: Float, PlanGuru, QuickBooks.

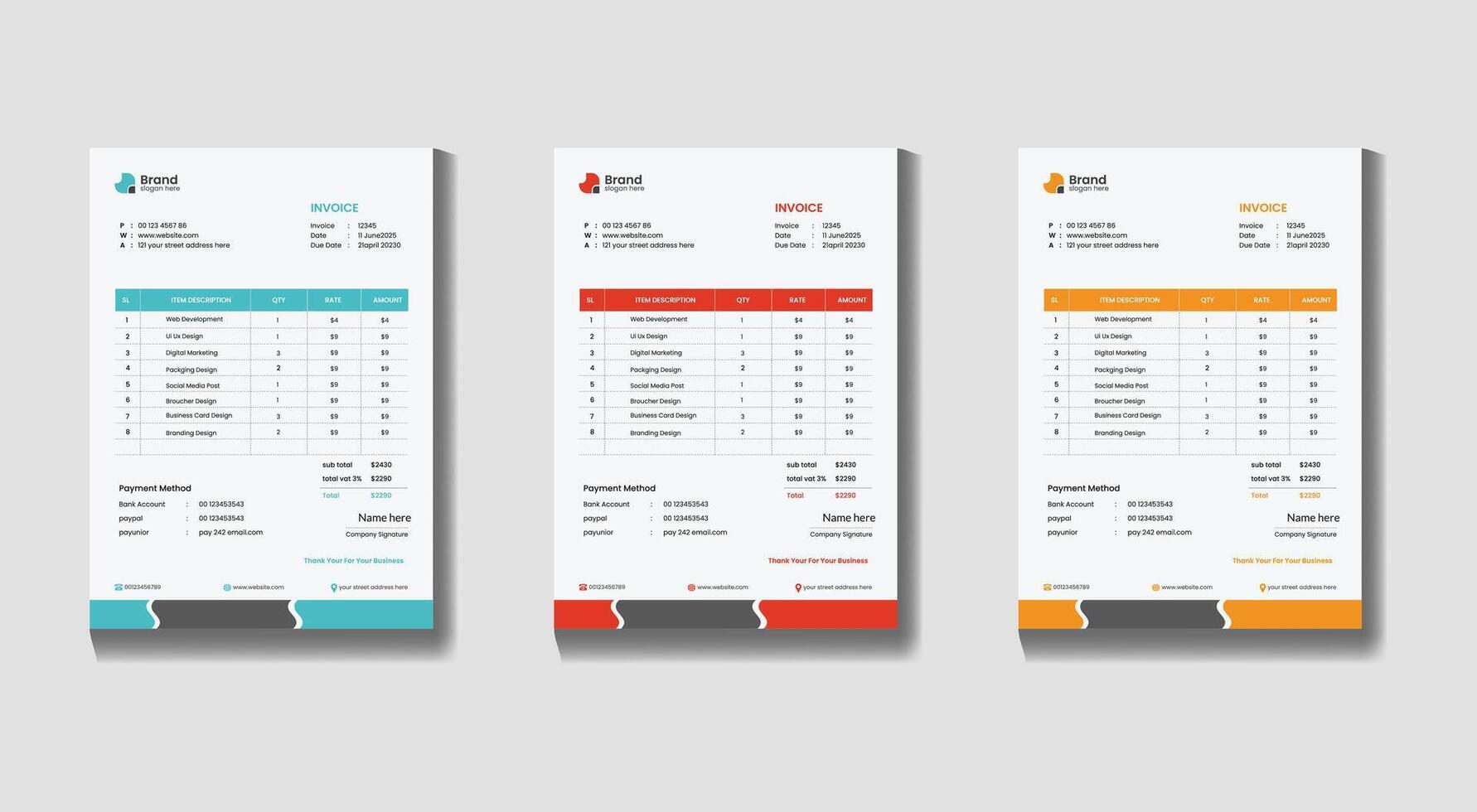

TL;DR: Summary of Time-Saving Accounting Automations

The following table summarizes the best accounting automation for small business, highlighting key benefits and time-saving accounting tools to streamline your finances.

| Automation | Key Benefit | Example Tools |

| Automated Invoicing | Improves cash flow | QuickBooks, Xero, FreshBooks, Fynlo |

| Expense Tracking Automation | Simplifies receipt management | Expensify, Zoho Expense, Receipt Bank |

| Payroll Automation | Ensures accurate payments | Gusto, ADP, Paychex |

| Bank Reconciliation | Enhances data accuracy | QuickBooks, Wave, Xero |

| Tax Preparation Automation | Eases tax season workload | TurboTax, TaxAct, H&R Block |

| Accounts Payable Automation | Streamlines bill payments | Bill.com, Tipalti, Melio |

| Accounts Receivable Automation | Speeds up payment collection | FreshBooks, Zoho Invoice, Invoice Ninja |

| Financial Reporting Automation | Delivers real-time insights | QuickBooks, Sage Intacct, NetSuite, Fynlo |

| Time Tracking Integration | Boosts billing efficiency | Toggl, Harvest, Clockify |

| Budgeting & Forecasting | Simplifies financial planning | Float, PlanGuru, QuickBooks |

What’s Next

Implementing these 10 time-saving accounting automations can transform how you manage your small business finances. From automating invoicing to forecasting cash flow, these easy bookkeeping automation solutions save hours each week, reduce errors, and empower you to focus on growth.

Ready to streamline your finances? Our time-saving accounting tools offer real-time tracking, seamless integrations, and powerful automation to boost your business. Schedule a call with our team to discover how we can help you save time and grow smarter.

For more financial management tips, check out our blogs: